Policymakers during COVID-19 operate in uncharted territory and must make tough decisions. Operational Research – the ubiquitous ‘science of better’ – plays a vital role in supporting this decision-making process. First spotted in Wuhan in China, the ongoing COVID-19 pandemic has triggered the most severe recession in nearly a century and, according to the OECD’s latest Economic Outlook, it has been causing enormous damage to people’s health, jobs, and well-being. COVID-19 has affected almost all countries in the world and, has practically put the entire planet on hold for more than 2 months. At the time this paper was being revised, the number of confirmed global cases was more than 13 million; the number of deaths crossed the mark of 500,000 in late June 2020 – standing at 571,689 as of 13–7–2020 (WHO, 2020). Unfortunately, the number of cases and deaths is still exhibiting significant growth in many countries, with the Americas (most notably the USA and Brazil) being at the pandemic’s epicenter.

Our generation has never met anything remotely similar to this pandemic. Despite HIV/AIDS being associated with far more deaths, the speed with which COVID-19 can kill even-perfectly-healthy humans (sometimes within just a few days), and the unprecedented disruption in work and a social life that it has brought (getting workers furloughed for months and the vulnerable part of the population in strict isolation for 12 weeks), makes this pandemic unique.

Covid-19 and Supply Chains

Furthermore, due to this pandemic and the associated global healthcare crisis, supply chains have faced significant disruptions upstream, while hoarding and panic buying caused equally significant disruptions downstream. The balance of supply and demand was further impacted by the travel restrictions and lockdowns implemented by several countries worldwide. Due to these disruptions, short-term real-time forecasts (daily and weekly) about the pandemic and its effect on the supply chain have become very important managerial and policy-making imperative. Mid-and long-term forecasts are essential tools for supply chain planning (at the monthly, quarterly, and annual frequency). However, research on these is more likely to be conclusive after the first wave of the pandemic is over, when more – and more reliable – supply chain data becomes available.

Related: COVID-19 – Impact on Global Supply Chains

Sales Forecasting for 2021

While 2020 has been anything but predictable, nobody knows exactly what 2021 holds. By taking a scientific approach to forecast your sales, you can avoid potential problems with your KPIs. It’s time to shift your sales process to focus on the future instead of dwelling on the past.

Few businesses were left untouched by COVID-19 and the associated recession. After months of operating on the fly and pivoting in response to external events, companies face a new challenge:

determining how to plot out their sales forecasts for the remainder of 2020 and all of 2021 while considering the question, “Can we weather another downturn?”

While the overall practice of sales is part art and part science, sales forecasting specifically has to be all science. Unfortunately, this is where many sales leaders go wrong. Predicting what will happen in the upcoming year based on what happened last year — or merely going with a gut feeling — might seem like an easy and fast way to project sales numbers. But now, with the added complexity of forecasting for an unknown future after COVID-19, using data and metrics is more crucial than ever.

The best forecasting method for sales begins with basing your numbers on key performance indicators (KPIs), also known as leading indicators. “Leading” refers to the fact that these metrics show you where you’ll finish in the future. Too often, though, businesses look at “lagging” indicators — the metrics for sales that have already happened. These indicators can’t offer insight into future performance because they can’t be changed. To most accurately predict sales, you have to look at numbers that can be dynamic and adapt to the markets.

Think of it this way: Imagine a professional baseball player who’s had a consistent career of batting over .300, with 30-plus home runs and 100-plus RBIs. Now, let’s say he got seriously injured and had to sit out most of last season. Would you be able to count on his previous performance to predict how he’d perform in the future? Not likely. Just as external factors affected his performance, COVID-19 has impacted countless businesses.

This is what we’re facing for the remainder of 2020 and 2021. For many business owners, what was once predictable is no longer certain. As a result, whether they’re looking at dynamic data or concrete data from times gone by will have major ramifications for their future success.

Outside Factors Impact Inside Performance

The aftershocks of the COVID-19 crisis will likely continue to complicate 2021 sales forecasts. Competitive threats, technological advances, and an increased regulatory environment always pose

challenges to accurate forecasting. There are even more factors at play as the economy works to recover, including fluctuations in raw material costs and availability as well as in consumers’ disposable income.

Because these forces alter what is normally predictable, they make your KPIs less predictive. To address this, you’ll want to recalibrate your sales process to reflect a new environment and focus on the future rather than the past:

Embrace experimentation

Now is the time to identify what will predict future success in 2021. Use the rest of 2020 to try different sales methods, figure out what works in this sales environment, and pivot accordingly.

For example, there’s a good chance face-to-face selling won’t be possible for the remainder of 2020 — and perhaps into 2021. If that’s the case, how do you need to change your sales process to allow for online demos or virtual selling? How will you train your sales team on these new processes? What will be the probability of closure at each of those new steps, and how will you measure that? To find these answers, you will have to experiment in 2020 and use that performance data to inform your 2021 sales forecasting methods.

Lock in your new sales process now — not in January

If you currently have a six-month sales cycle (prospect-to-client), you’re already behind. Wait until January, and half your year will already be gone by the time you introduce your new process. Keep in mind that your sales forecasting methods should focus on activities that happen at the top of the sales funnel, prior to a proposal. Document your current sales process with all possible steps that could take place. What is the probability of closure for each? What is the probability you’ll get to a first meeting, and what percentage of the time does each activity turn into a sale? If you can’t answer these questions, your sales process isn’t built on the right leading indicators — and your forecast won’t be sound.

Ramp up your sales force

Seize this opportunity to audit your current sales team and approach. Will you need to identify new products, channels, or decision-makers? Do you have the right people in place to do so? What training and reorganization will you need? Work with your leadership team to talk through these questions. Get your sales forecasting models fully fleshed out before presenting anything to the rest of the leadership team. No one knows exactly what 2021 will bring. By iterating now to find your company’s new modus

an operand and then determining what’s possible in this evolving environment, you’ll take the scientific

approach necessary to forecast your sales for 2021 more accurately.

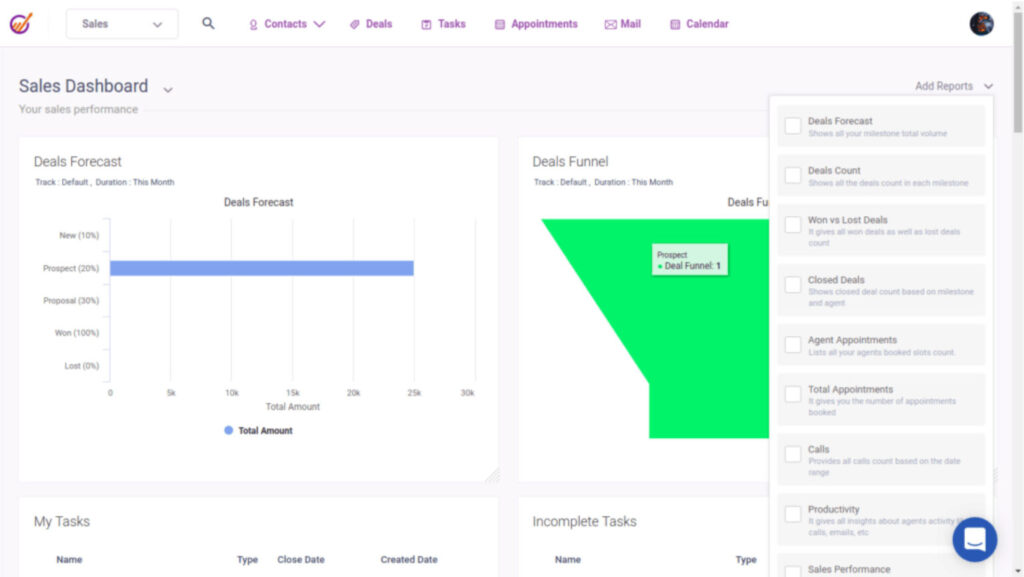

The tools you need for sales forecasting in 2021

Sales forecasting is important for any business because it gives companies the chance to predict growth and if they spot trends, they can help come up with effective strategies and make decisions to help their business. Furthermore, whilst forecasting is predictive and intuitive, there has to be an element of data-driven quantitative analysis that goes into this exercise, hence having a healthy combination of both qual and quant data is best. To aid businesses in their quest of producing ratifiable and realistic forecasts, there are tools out there that can help. It is a very crowded marketplace and a number of providers offer useful tools but as the nature of procuring software evolves, the best tools are going to be dependent upon the size of the business, usage, location, and how you intend on using it. There are, however, 4 simple overarching questions you should ask yourself:

• Does the tool offer dynamic or static forecasts? The former clearly has more value in the start-up world

• Does it, and how does it integrate with other bits of tech, and can it be imported? Data being imported with one click as opposed to manually uploading things can save hours

• Is it collaborative? Look for one that is, and encourages wide team adoption.

• Is it easy to use? New tech can often take a while to bed in so the easier it is to use, the better.

Clari – a great revenue operations platform, and notably one of the largest players in this market. Their support is great too, so whilst there will be a price tag and they are most definitely not the cheapest, you will extract value from their software.

Ebsta – a revenue intelligence platform. UK-based and a start-up themselves, their whole premise is to track engagement at the deal level i.e. the more engaged you are with more people at a business, the more likely they are to buy. One thing to note is that this tool is to be used with Salesforce to be optimal. If you use another CRM, it does work, just not as well.

HubSpot – great features including forecasting, goals, and quota attainment. They recently brought out Sales Analytics as an additional tool that gives you a number of different forecasting sub-categories drilling down into serious detail which can inform your decisions very robustly.

Salesdirector.ai – SalesDirector, a conversational AI assistant, helps give a complete revenue picture and gives helpful insights towards scaling the sales team. Also, pipeline visibility helps companies identify challenges and areas for growth. It also offers suggestions when a new pipeline is needed.

Sales Forecasting

Often, you wish there was a way for you to look into the proverbial crystal ball to predict future sales. After all, at current, your sales come in when they come in. Sometimes your sales team is overloaded and frazzled and other times they’re struggling to pull in but a single lead. This track record of unpredictability can be a waste of your time, energy, money, and resources. Instead of blindly guessing what your sales future may hold, there’s a way to know with more certainty. It’s known as sales forecasting.

If you’re not yet doing any sales forecasting for your company, that’s something you’ll definitely want to change for the year ahead. In this extensive guide, we’ll explain all things sales forecasts. From sales forecasting meaning to tips and strategies on how to make a forecasting sales plan (with examples), you’ll be all set to debut your forecast for 2021. In fact, you’ll almost feel like you have a 2021 sales-projecting vision.

As we said, we want to start with a sales forecast definition. This way, we’re on the same page going forward. Okay, so what does it mean when you forecast your sales anyway? Sales forecasting predicts what your sales pipeline may look like in the future. Now, you don’t just reach into your magic hat and pull out the first sales number that comes to mind. You also don’t inflate your sales to an unreasonably high degree.

Sales forecasting isn’t random. If it was, it’d be pointless. Instead, it’s based on actual sales data and trends. While it doesn’t hit the mark every single time, you can increase your forecast accuracy by using your own company’s data. Besides that, you also want to rely on current trends in economics and trends in your industry to shape what will become your future sales prediction.

Related Posts:

What are Sales Forecasting and Demand Management?

What is Demand Forecasting and Why it is Important?

Danish Mairaj is a medical device expert with a strong focus on regulatory and quality compliance. He has been involved in managing clinical trial infrastructure including supplies and logistics. He has over 15 years of experience in the MedTech and Pharmaceutical industry. He is a certified Product Owner, Scrum Master, and Project Management Professional PMP. He studied Biomedical Engineering in Germany and MedTech Regulatory & Quality in Galway, Ireland. He contributes articles to the BRASI newsletter.

- Danish Mairaj#molongui-disabled-link